Rental Affordability Statistics as of 2020 Q3

38% of renters can afford to buy a home but need 13 years of savings to make a 10% down payment.

The housing market has had a spectacular recovery since May with rental affordability, but at the same time, home prices have been surging. This blog explores how much tougher or easier it has become for renters to achieve the dream of homeownership. As of 2020 Q3, the fraction of renters that can afford a home has increased since 2018, to 39%, but achieving the dream of homeownership is still difficult for renters in terms of paying the monthly mortgage (mortgage payment accounts for 29% of income) and making a 10% down payment of about $31,350 (at current median single-family sales price), which is equivalent to 13 years of savings.

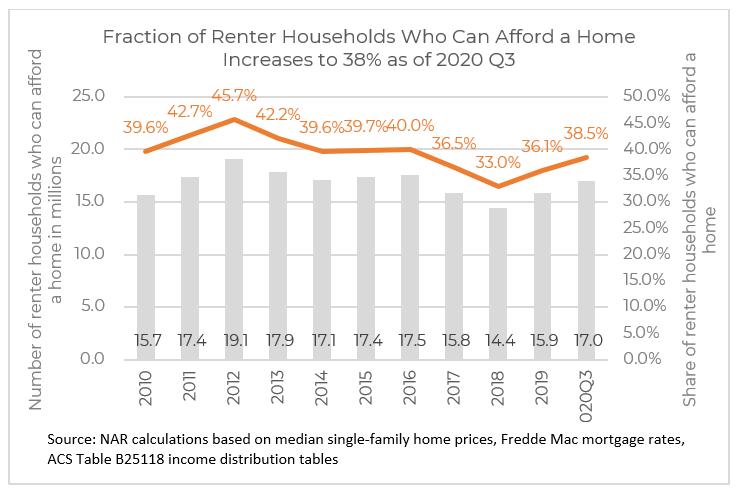

1. 39% of renter households can afford to purchase a single-family home as 2020 Q3

As mortgage rates have fallen and incomes have increased, the fraction of renters who can afford to purchase a home has increased from 33% in 2018 to 38% as of 2020 Q3.

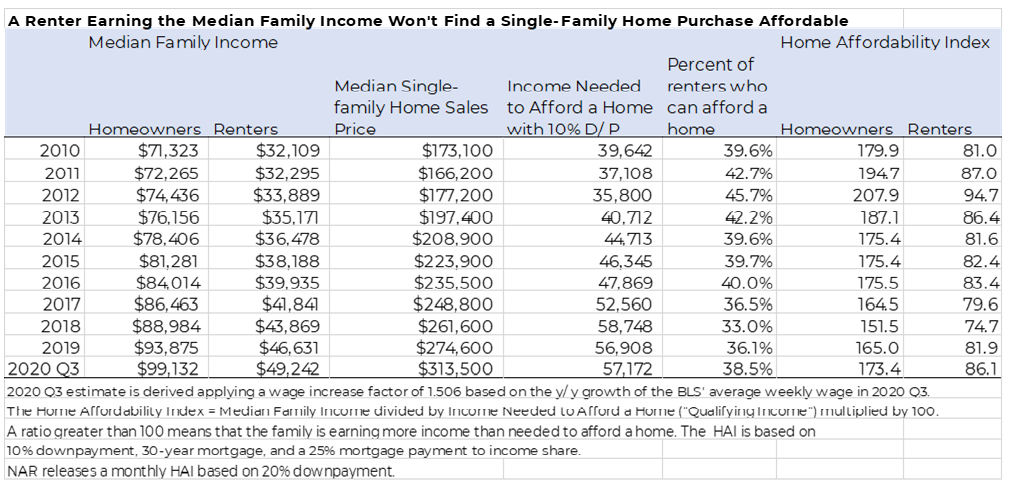

2. A renter will typically spend 29% of income on mortgage payment

However, while a home purchase has become more affordable, a renter with a family income of $49,242 or below will not be able to afford a typical single-family home valued at 313,500 as of 2020 Q3. If a renter purchased a single-family home in 2020 Q3, the mortgage payment will account for 29% of income, which is above the threshold of 25%.1

Another way to assess affordability is to compare the median family income to the income needed so that the renter will not spend more than 25% of income on mortgage payment (qualifying income). In 2020 Q3, the estimated median family income of a renter was $49,242, which is below the level of income needed to afford a home, at $57,172 ( so the home affordability index is 86.1). In comparison, current homeowners whose family income is about double the median family income of renters have more than the income needed to purchase a typical single-family home (so the home affordability index is 173.4). See Table 1).

Only one in five renters can afford to buy a home in these metro areas: Honolulu Hawaii; San Diego California; Boulder, Colorado; Barnstable, Mass.; Eugene, Oregon; Naples, Florida; Bridgeport-Stamford, Conn., and Boston, Mass.

Nationally, a renter will typically spend 29% of income on mortgage payment, which makes a home purchase unaffordable. Of 172 metro areas for which NAR has metro level data, 55% of metro areas are not affordable.

In expensive metro areas such as San Jose, Honolulu, San Francisco, a renter will spend more than half of his income on mortgage payment, a severe burden for renters.

Use the data visualization to explore the renter affordability statistics in your metro area:

3. A renter will need about $30,000 for a 10% down payment and 13 years of savings

According to NAR’s 2020 Profile of Home Buyers and Sellers, first-time buyers typically financed 93% of their home, or put down 7% for down payment. NAR’s monthly Realtors® Confidence Index survey places the average down payment among first-time buyers at around 9% to 10%. While a 3% FHA loan is available, first-time buyers are putting down a higher down payment, presumably to save on the monthly mortgage payment.

In almost all of the 172 metro areas analyzed, nearly all will require at least $15,000 for a 10% down payment, except for 11 metro areas such as Decatur, Illinois; Cumberland, MD; Elmira, NY; Youngstown, Ohio; Peoria, Illinois; Binghamton, New York; Waterloo, Iowa; Rockford, Illinois; and Davenport, Iowa.

At a 10% down payment, a renter needs $31,350 given the current single-family median sales price. This is equivalent to 13 years of savings, assuming a 5% savings rate and no change in income.2 In the most expensive metro area of Hawaii, San Jose, San Diego, and Boulder, it’ll take more than 20 years to save for a down payment! It will take at least 5 five years to save for a down payment even in inexpensive metro areas such as Fond du Lac, Wisconsin; Bloomington, Illinois; Waterloo Iowa; Wichita Falls, Texas; Decatur, Illinois; Glenn Falls, New York.

Due to the long time to save for a down payment, President Biden’s homebuyer tax credit will help speed up the home purchase for many renters and enable them to gain housing wealth from the home price appreciation earlier.

But this will mean that supply has to increase so prices don’t also rise even more amid tight supply conditions.

Read full article Here.